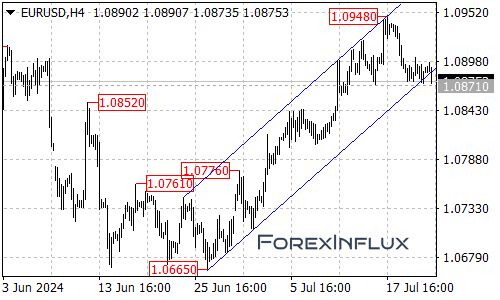

The Euro/US Dollar (EURUSD) pair has shown some interesting movements recently. Let’s break down the current situation and potential scenarios based on the 4-hour chart analysis.

Recent Developments

- EURUSD has broken below the rising price channel on the 4-hour chart.

- The pair is currently testing a crucial support level at 1.0871.

Bearish Scenario

If EURUSD breaks below the 1.0871 support:

- It would suggest that the upward movement from 1.0665 has peaked at 1.0948.

- The next target levels would be:

- 1.0830

- 1.0800 area

Bullish Scenario

As long as the 1.0800 support holds:

- The upward movement from 1.0665 could potentially resume.

- Another rise towards 1.1000 remains possible.

Key Levels to Watch

Support Levels

- Critical support: 1.0871

- Strong support: 1.0800

Resistance Levels

- Initial resistance: 1.0910

- Previous high: 1.0948

- Psychological level: 1.1000

Potential Upside Movement

If EURUSD breaks above the initial resistance:

- It could trigger another rise to test the previous high of 1.0948.

- A break above 1.0948 would target the psychologically important 1.1000 level.

Conclusion

The EURUSD pair is at a critical juncture. Traders should closely monitor the key support and resistance levels mentioned above. The break of 1.0871 could signal a bearish trend, while holding above 1.0800 keeps the bullish scenario alive. As always, use proper risk management and stay informed about market conditions before making trading decisions.