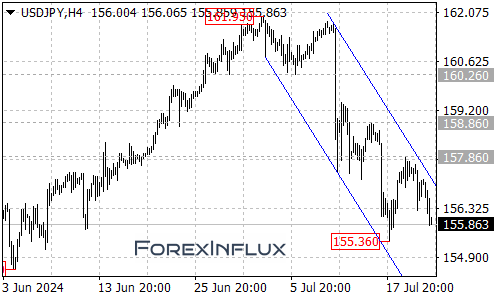

The US Dollar/Japanese Yen (USDJPY) pair has been showing some interesting patterns lately. Let’s break down the current situation and potential scenarios based on the 4-hour chart analysis.

Current Trend

- USDJPY is currently moving within a falling price channel on the 4-hour chart.

- This suggests that the pair is maintaining its downtrend from the recent high of 161.95.

Bearish Scenario

As long as the price remains within the channel:

- The downward movement is expected to continue.

- If the price breaks below the 155.63 support level, we could see further downside movement.

- Potential target levels in this scenario:

- First target: 154.50

- Next target: 153.90 area

Bullish Scenario

For a bullish reversal, we’d need to see:

- A breakout above the channel’s resistance line.

- If this occurs, the next resistance level to watch is 157.86.

- A break above 157.86 could push the price towards 158.86.

Key Levels to Watch

Support Levels

- Critical support: 155.63

- Next support: 154.50

- Further support: 153.90 area

Resistance Levels

- Channel resistance (variable, check the chart)

- Next resistance: 157.86

- Further resistance: 158.86

Conclusion

The USDJPY pair is currently in a downtrend, moving within a falling price channel. Traders should keep a close eye on the channel boundaries and the key support/resistance levels mentioned. A break below support could accelerate the downtrend, while a break above the channel resistance might signal a potential reversal.

Remember, always use proper risk management techniques and stay informed about broader market conditions that could impact currency movements.