On Friday, July 19th, the Australian Dollar (AUD) faced some challenges against the US Dollar (USD):

- AUD/USD fell to 0.6660, its lowest level since July 3rd

- This decline was influenced by several factors affecting market sentiment

Factors Influencing the Market

Risk Aversion

- Widespread risk aversion in global markets has been weighing on the AUD

- Global stock market declines have put pressure on risk-sensitive currencies like the AUD

US Treasury Yields

- US Treasury yields have rebounded after a period of weakness

- This rebound has strengthened the USD, putting pressure on the AUD/USD pair

Commodity Prices

- Iron ore prices, a key Australian export, have fallen

- This decline has negatively impacted the AUD

Positive Signs for the AUD

Despite the recent challenges, there are some positive indicators for the AUD:

- CFTC data (as of July 16th) shows net long positions in AUD for the first time since May 2021

- Diverging monetary policy expectations between the US Federal Reserve and the Reserve Bank of Australia could help limit AUD’s downside

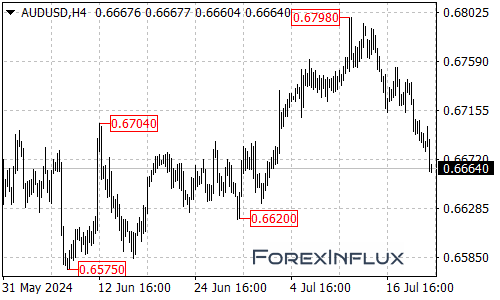

Technical Analysis

From the daily chart:

- The trend is slightly unfavorable for AUD’s upward movement

- Key levels to watch:

- Support: 0.6660

- Resistance: 0.6720

As long as AUD/USD stays above 0.6660 and can reclaim levels above 0.6720, it may avoid a significant downtrend.

Conclusion

While the AUD faces some headwinds due to global risk aversion and commodity price declines, there are also factors that could support the currency. Traders should keep an eye on global risk sentiment, commodity prices, and central bank policies for potential trading opportunities.

Remember to always use proper risk management techniques and stay informed about market conditions before making any trading decisions.