On Friday, July 19th, the USD/JPY pair saw some interesting movements:

- Closed at 157.48, up 0.07% intraday

- Fluctuated throughout the day

- Ended the week down 0.24%

Factors Influencing the Market

Japanese Inflation

- Japanese inflation rose for the second consecutive month

- This news caused some fluctuation in the USD/JPY pair

Bank of Japan (BOJ) Meeting Minutes

- The BOJ’s bond market group suggested reducing Japanese government bond purchases to 3-4 trillion yen per month

- This news provided some support for the yen

Looking Ahead

Upcoming BOJ Meeting

- The BOJ’s interest rate meeting is scheduled for the end of July

- If Japanese authorities don’t raise interest rates, the yen might face some pressure

Technical Analysis

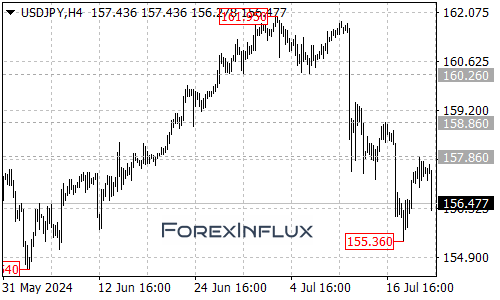

From the daily chart, the downward trend of USD/JPY shows no signs of changing yet. Key levels to watch:

Resistance Levels

- First key resistance: 157.86

- Next resistance: 158.86

Support Levels

- Recent support: 155.00 – 155.20

- Thursday’s low: 155.36

Conclusion

The USD/JPY pair continues to be influenced by economic data and central bank policies. Traders should keep an eye on the upcoming BOJ meeting and monitor key technical levels for potential trading opportunities.

Remember to always use proper risk management techniques and stay informed about market conditions before making any trading decisions.