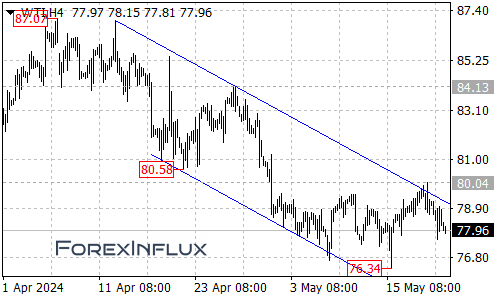

The West Texas Intermediate (WTI) crude oil futures contract remains entrenched in a downtrend that commenced from the 87.07 level. The price action has been confined within a falling price channel on the 4-hour chart, suggesting that the recent bounce from the 76.34 low could be viewed as a consolidation phase within the broader downtrend.

As long as the price respects the boundaries of this falling channel, another decline to test the 76.34 support level is likely to be witnessed in the coming days. However, a breakdown below this crucial support could potentially signal a resumption of the downtrend, with the next targets for the bears being the 75.70 area, followed by the 72.00 zone.

On the upside, traders should closely monitor the resistance provided by the upper boundary of the falling price channel. A decisive breakout above this channel resistance could potentially lead the WTI futures contract towards the next resistance level at 80.04.

If the price manages to surpass the 80.04 resistance, it would be a significant development, indicating that the downside move from the 87.07 high has likely completed at the 76.34 low. In such a scenario, the next targets for the bulls would be the 80.40 level, followed by the 84.00 area.

In summary, the WTI crude oil futures contract remains entrenched in a downtrend, trading within a falling price channel on the 4-hour chart. While another test of the 76.34 support is likely in the near term, a breakdown below this level could potentially signal a resumption of the broader downtrend, with the 75.70 and 72.00 areas serving as potential targets for the bears.

Conversely, a breakout above the channel resistance could potentially lead to a move towards the 80.04 resistance, and a sustained move above this level could potentially signal the completion of the downside move from 87.07, with the 80.40 and 84.00 levels acting as potential upside targets.

Traders and investors are advised to closely monitor the price action around these crucial support and resistance levels to gauge the potential direction of the WTI crude oil futures contract in the coming days.