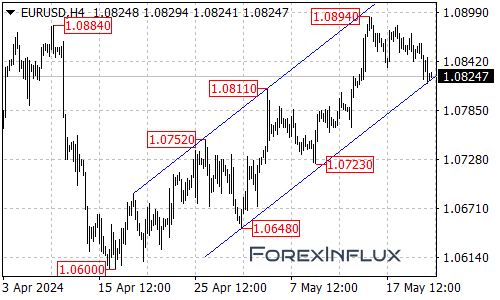

The EURUSD currency pair has been capturing the attention of traders with its recent price action. After a surge from 1.0600 to 1.0894, the pair has been experiencing a pullback, currently trading as low as 1.0817.

This pullback has brought the pair face-to-face with the support of a rising price channel on the 4-hour chart. This channel has been a key technical feature guiding the recent uptrend, and its significance cannot be overstated.

If the channel support holds firm, traders may interpret this pullback as a healthy consolidation phase within the broader uptrend. In this scenario, another rally towards the psychologically significant 1.1000 level could be on the cards once the consolidation phase concludes.

However, before we get ahead of ourselves, there are some immediate resistance levels to keep an eye on. The first hurdle lies at 1.0860. A decisive break above this level could trigger further upside momentum, potentially testing the previous high of 1.0894. Surpassing this level would open the door for a push towards the 1.1000 area.

On the flip side, if the pair breaches the bottom of the rising price channel, it could signal that the upside move from 1.0600 has already exhausted itself at 1.0894. In this bearish scenario, further declines could unfold, with the next target potentially residing at the 1.0800 level, followed by the 1.0725 area.

As traders, it’s crucial to remain vigilant and adapt to the ever-changing market dynamics. By closely monitoring these key levels and the price action around the rising price channel, you can better position yourself to capitalize on potential opportunities or mitigate risks.