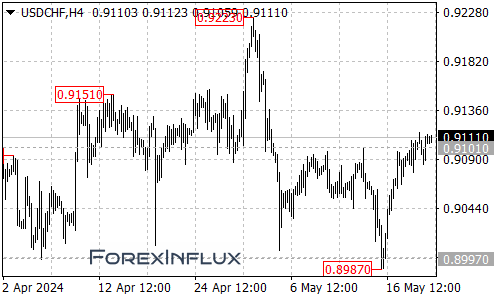

The USD/CHF currency pair has recently witnessed a bullish breakout, surpassing the 0.9101 resistance level. This development suggests that further upside momentum could be on the cards for the pair after a potential minor consolidation phase.

The next target for the bulls in the USD/CHF is the 0.9150 area, which could act as a significant resistance zone. A decisive move above this level could potentially pave the way for a continuation of the uptrend.

However, it’s important to note that the path higher may not be without obstacles. The initial support for the USD/CHF is currently situated at the 0.9060 level. If the pair encounters selling pressure and fails to hold above this support, it could potentially lead to a pullback towards the crucial 0.8997 support level.

A breakdown below the 0.8997 support could potentially expose the 0.8890 area, which could act as a significant target for the bears in the event of a more substantial correction.

In summary, the USD/CHF has broken above the 0.9101 resistance, suggesting that further gains could be on the horizon after a potential minor consolidation phase. The next target for the bulls is the 0.9150 area, which could act as a significant resistance zone.

However, traders should remain vigilant and closely monitor the price action around the 0.9060 support level and the critical 0.8997 support. A failure to hold above these levels could potentially lead to a more significant pullback, potentially targeting the 0.8890 area.