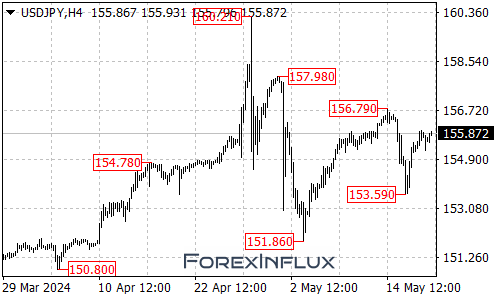

After a recent corrective pullback from 156.79, the USD/JPY currency pair has shown resilience by rebounding from 153.59. This bounce has propelled the pair to as high as 155.97, indicating potential for further upward movement.

Looking ahead, it is likely that the pair will continue to rally in the coming days, with the next target set at the 156.79 resistance level. A decisive break above this barrier would signal a resumption of the upside momentum from the low of 151.86, paving the way for a potential move towards the 158.00 area.

On the downside, initial support is identified at 155.10. A breach below this level could trigger a retest of the 153.59 support, with further downside potential towards the 153.00 area.

In summary, the USD/JPY pair has exhibited strength by bouncing from the 153.59 level and reaching as high as 155.97. The outlook suggests a potential for further upside, with a target at the 156.79 resistance level. However, traders should also be mindful of the support levels at 155.10 and 153.59, as a breakdown below these levels could shift the near-term bias to the downside.

In conclusion, the recent rebound in USD/JPY from 153.59 underscores the resilience of the pair and sets the stage for potential further gains. With a clear upside target at 156.79 and support levels at 155.10 and 153.59, traders have key technical levels to watch as they navigate the currency markets in the near term.