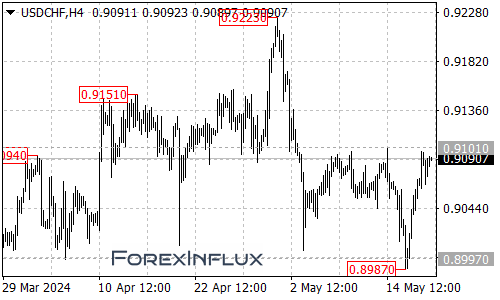

The USD/CHF currency pair has recently witnessed a notable rebound after testing the crucial support level at 0.8997. The pair touched a low of 0.8987 before staging a recovery, and it is now facing resistance at the 0.9101 level.

If the USD/CHF manages to break out above the 0.9101 resistance, it could potentially trigger further upside momentum. The next target for the bulls would be the resistance level around the 0.9150 area. A sustained move above this level could potentially set the stage for a rally towards the previous high of 0.9223.

However, it’s important to note that the path higher may not be without obstacles. The initial support for the USD/CHF is currently situated at the 0.9050 level. If the pair encounters selling pressure and fails to hold above this support, it could potentially lead to a pullback towards the 0.8997 support level.

A breakdown below the 0.8997 support could potentially expose the 0.8890 area, which could act as a significant target for the bears in the event of a more substantial correction.

In summary, the USD/CHF has staged a rebound after testing the 0.8997 support level, and it is now facing resistance at the 0.9101 level. A breakout above this resistance could potentially pave the way for further gains towards the 0.9150 area and potentially the previous high of 0.9223.

However, traders should remain vigilant and closely monitor the price action around the 0.9050 support level and the critical 0.8997 support. A failure to hold above these levels could potentially lead to a more significant pullback, potentially targeting the 0.8890 area.

Traders and investors are advised to stay agile and adapt their strategies based on the evolving price action in the USD/CHF currency pair.