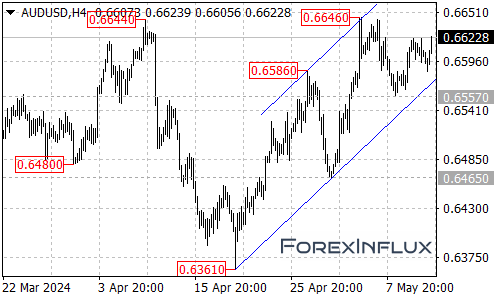

The AUD/USD currency pair has recently faced resistance in its attempt to break below the support of the rising price channel on the 4-hour chart. Instead of a decisive breakdown, the pair has been moving sideways, trading within a range between 0.6557 and 0.6646.

As long as the price respects the support of this rising channel, the current sideways move could be viewed as a consolidation phase within the broader uptrend that commenced from the 0.6361 level. In this scenario, a breakout above the 0.6646 resistance could potentially trigger further upside momentum.

If the AUD/USD manages to surpass the 0.6646 resistance, the next target for the bulls would be the resistance level around 0.6720, followed by the 0.6790 zone.

However, traders should also remain vigilant for potential bearish signals. A breakdown below the rising channel support could potentially lead the AUD/USD towards the next support level at 0.6557.

If the pair breaches the 0.6557 support, it could potentially indicate that the upside move from the 0.6361 low has completed at the 0.6646 high. In such a scenario, the next target for the bears would be the 0.6465 support level.

In summary, the AUD/USD is currently consolidating within a rising price channel on the 4-hour chart, trading within a range between 0.6557 and 0.6646. As long as the channel support holds, the overall bias remains bullish, with a potential breakout above the 0.6646 resistance potentially paving the way for further gains towards the 0.6720 and 0.6790 levels.

However, traders should closely monitor the price action around the rising channel support and the 0.6557 level, as a breakdown below these levels could potentially signal a bearish reversal, with the 0.6465 level acting as the next target for the bears.

Traders and investors are advised to stay agile and adapt their strategies based on the evolving price action in the AUD/USD currency pair.