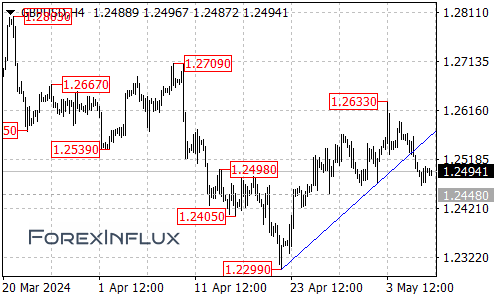

The GBP/USD currency pair has witnessed a significant bearish development, breaking below the rising trend line on the 4-hour chart. This breakdown suggests that the recent upside move from the 1.2299 level has likely completed at the 1.2633 high.

With this bearish signal, a deeper decline in the GBP/USD is anticipated in the coming days, with the initial target being the 1.2448 support level. If the selling pressure persists and the pair breaches this support, it could potentially trigger a further downside move towards the 1.2400 area.

Moreover, a sustained move below the 1.2400 level could potentially open the door for a retest of the previous low at 1.2299, which could act as a significant target for the bears.

However, it’s important to note that the GBP/USD could potentially face resistance levels on the upside. The initial resistance is currently situated at the 1.2520 level. If the pair manages to regain strength and break above this level, it could potentially lead to a move towards the next resistance level around 1.2570.

A sustained move above the 1.2570 resistance could potentially shift the focus towards the previous high of 1.2633, potentially signaling a temporary respite from the bearish momentum.

In summary, the GBP/USD has broken below a critical support level, suggesting that the recent upside move has likely concluded. The pair is now facing potential downside risks, with the 1.2448, 1.2400, and 1.2299 levels acting as potential targets for the bears.

On the upside, traders should closely monitor the 1.2520 and 1.2570 resistance levels, as a break above these levels could potentially lead to a retest of the 1.2633 previous high.

Traders and investors are advised to remain vigilant and adapt their strategies based on the evolving price action in the GBP/USD currency pair.