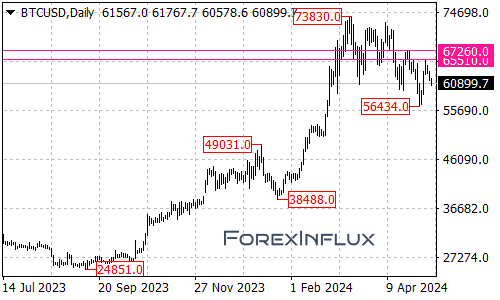

The cryptocurrency market has witnessed a significant correction in the Bitcoin (BTC/USD) pair, with the price declining from the 73830 level to as low as 56434. This downward move has raised concerns among traders and investors, but it’s important to analyze the broader context.

While further declines in BTC/USD are still possible in the coming days, with the next potential target being the 52000 area, it’s crucial to understand that the current pullback could be a consolidation phase within the broader, long-term uptrend that commenced from the November 2022 low of 15385.

If this is indeed the case, another rise in BTC/USD could potentially be expected after the current consolidation phase, potentially signaling a continuation of the uptrend.

On the upside, the initial resistance for BTC/USD is currently situated at the 62400 level. A decisive break above this level could potentially trigger further upside momentum, potentially leading to a test of the 65510 resistance, followed by the 67260 level.

Should BTC/USD surpass these resistance levels, it would be a significant bullish signal, indicating that the long-term uptrend has potentially resumed. In such a scenario, the next target for the bulls would be the previous high of 73830.

In summary, while the BTC/USD pair has experienced a significant pullback from the 73830 level, the broader picture suggests that the current decline could be a consolidation phase within the long-term uptrend that commenced from the November 2022 low.

Traders and investors should closely monitor the price action around the 62400, 65510, and 67260 resistance levels, as a break above these levels could potentially signal a resumption of the uptrend, potentially paving the way for a move towards the previous high of 73830.

It’s important to remain vigilant and adapt trading strategies based on the evolving market conditions, as the cryptocurrency market is known for its volatility and potential for rapid price movements.