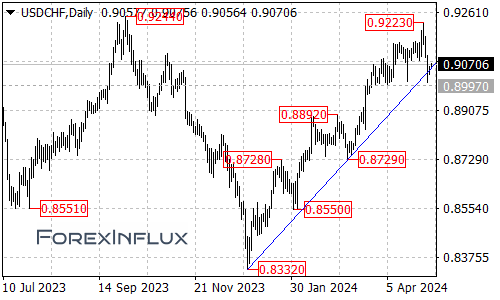

The USD/CHF currency pair has witnessed a significant development, breaking below the rising trend line on the daily chart. This bearish move has brought the pair towards a crucial support level at 0.8997.

As long as the 0.8997 support holds firm, the recent pullback from the 0.9223 high could be viewed as a consolidation phase within the broader uptrend that commenced from the 0.8332 low. In this scenario, another rally to retest the 0.9223 resistance level could potentially be on the cards.

If the USD/CHF manages to break above the 0.9223 resistance, it could potentially signal a resumption of the uptrend, with the next target for the bulls being the 0.9350 area.

However, traders should also remain cautious of the potential bearish implications of a breakdown below the 0.8997 support level. Such a development would indicate that the upside move from the 0.8332 low has likely completed at the 0.9223 high.

In the event of a breakdown below 0.8997, further declines towards the 0.8900 area could potentially be witnessed, potentially marking the start of a broader corrective move or a reversal of the previous uptrend.

In summary, the USD/CHF is currently at a critical juncture, with the 0.8997 support level acting as a crucial pivot point. A successful defense of this support could potentially pave the way for another rally towards the 0.9223 resistance and potentially the 0.9350 area if the uptrend resumes.

Conversely, a breakdown below the 0.8997 support could potentially signal the completion of the upside move from 0.8332, potentially leading to further declines towards the 0.8900 area.

Traders and investors are advised to closely monitor the price action around these key levels to gauge the potential direction of the USD/CHF in the coming days.