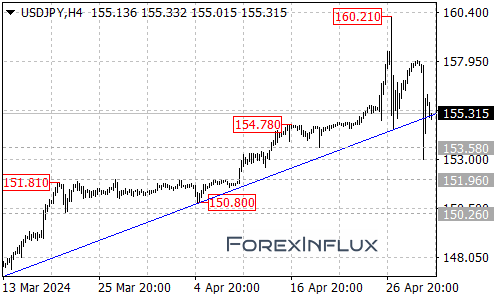

The USD/JPY currency pair has recently experienced a significant bearish development, breaking below the rising trend line on the 4-hour chart and the key support level at 153.58. This breakdown suggests that the upside move from the 146.47 level has likely completed at the 160.21 high.

With this bearish signal, further declines in the USD/JPY could be on the horizon in the coming days. The next target for the bears is the 151.50 area, which could act as a potential support zone.

However, it’s important to note that the path lower may not be without obstacles. The initial resistance for the USD/JPY is currently situated at 156.30. If the pair manages to regain strength and break above this level, it could potentially trigger an upside move towards the 158.00 resistance zone.

Should the USD/JPY surpass the 158.00 level, it could potentially aim for the 159.40 area, potentially invalidating the bearish outlook and signaling a continuation of the previous uptrend.

In summary, the USD/JPY has broken through a critical support level, suggesting that the recent upside move may have concluded. The pair is now facing potential downside pressure, with the 151.50 area serving as the next target for the bears. However, traders should remain vigilant for potential resistance levels at 156.30 and 158.00, as a break above these levels could potentially negate the bearish bias and pave the way for a potential move towards the 159.40 zone.

Traders and investors are advised to closely monitor the price action around these key levels to gauge the potential direction of the USD/JPY in the coming days.