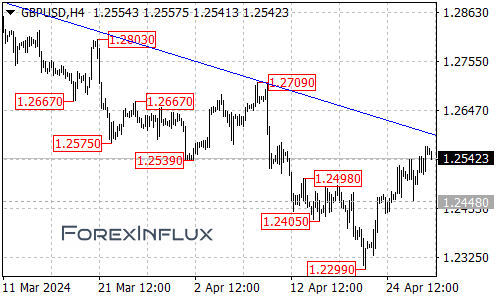

The British pound has strengthened against the US dollar, with the GBP/USD currency pair extending its upside move from the 1.2299 level to as high as 1.2569. This rally could potentially continue, with the next target being the falling trend line on the 4-hour chart.

If the GBP/USD manages to break through this trend line resistance, it would be a significant development, indicating that the downtrend from the 1.2893 high has already bottomed out at 1.2299. Such a breakout could pave the way for further gains, with the next targets being the 1.2700 level, followed by the 1.2780 area.

However, as long as the falling trend line resistance holds firm, the current rise from 1.2299 could be viewed as a corrective move within the broader downtrend that began from the 1.2893 level. In this case, another decline towards the 1.2300 area cannot be ruled out after the current correction phase.

In terms of immediate support levels, traders should closely monitor the 1.2500 level. A breakdown below this level could potentially push the price back to test the 1.2448 support. If this support level is breached, the focus would shift towards the 1.2400 area, followed by the 1.2300 zone.

To summarize, the GBP/USD has extended its rally, but faces a crucial resistance level in the form of a falling trend line on the 4-hour chart. A breakout above this resistance would be a bullish signal, potentially signaling the end of the downtrend from 1.2893. However, if the trend line resistance holds, the current upside move could be a temporary correction within the broader downtrend, paving the way for another decline towards the 1.2300 area.