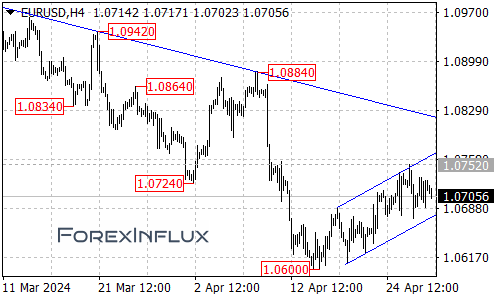

The EUR/USD currency pair continues to trade within a rising price channel on the 4-hour chart, suggesting the short-term uptrend from the 1.0600 level remains intact. As long as the price respects the boundaries of this channel, the upside momentum could persist, with the next target area being 1.0800.

However, the pair faces a significant hurdle in the form of a falling trend line on the 4-hour chart, currently situated around the 1.0820 level. If the EUR/USD manages to break above this resistance, it would be a bullish signal, potentially opening the door for further gains.

On the other hand, if the pair fails to surpass the falling trend line, the recent bounce from 1.0600 could be interpreted as a corrective move within the broader downtrend that commenced from the 1.0981 level. In such a scenario, another decline towards the 1.0500 area cannot be ruled out after the current correction phase.

In terms of immediate support, traders should keep an eye on the bottom of the rising price channel. A breakdown below this support level could trigger a further downside move, initially testing the 1.0600 support. A breach of the 1.0600 level would then expose the 1.0500 area.

To summarize, the EUR/USD remains in a bullish mode in the short term, but faces a crucial resistance level around 1.0820. A breakout above this level could reinforce the uptrend, while a failure to do so could signal a continuation of the broader downtrend.