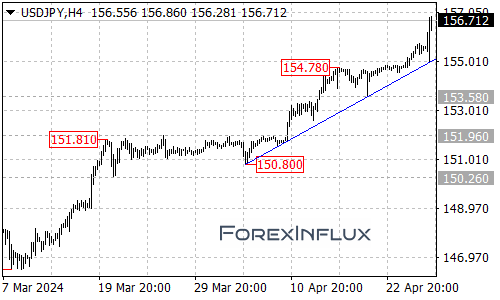

The USDJPY currency pair continues to exhibit bullish momentum, with the pair trading comfortably above a rising trendline visible on the 4-hour chart timeframe. This technical posture suggests that the broader uptrend from the 150.80 low remains firmly intact at the moment.

Riding the wave of this uptrend, USDJPY has managed to rally as high as 156.86 in recent trading. As long as the pair holds above that all-important rising trendline support area, the path of least resistance still appears to favor further upside potential in the days and weeks ahead.

The next key target that bulls will be watching on an extended move higher is the psychologically-important 159.00 handle. A push through 159.00 would reinforce the bullish technical forecast, potentially opening the door for another impulsive wave of momentum buying.

In the near-term, the first meaningful support for USDJPY has arrived at the 156.20 level. While any dips toward this area could present buying opportunities for momentum traders looking to position in line with the dominant uptrend, a breakdown below 156.20 would raise more significant concerns.

Specifically, a plunge through 156.20 support would see USDJPY revisiting a test of the rising trendline support on the 4-hour chart next. But more importantly, only a clear violation of that trendline support area would confirm that a bullish-to-bearish trend reversal may be underway.

For now, the overall technical bias remains skewed to the topside as long as USDJPY holds above the noted trendline support area. The focus will be on whether the bulls can extend the uptrend towards and potentially through the 159.00 target resistance zone next.

But any cracks in the bullish posture in the form of a trendline breakdown would be a significant technical event, raising doubts over the sustainability of the advance off the 150.80 lows. Such a scenario could open the door for a more significant bearish correction or consolidation phase to potentially develop.