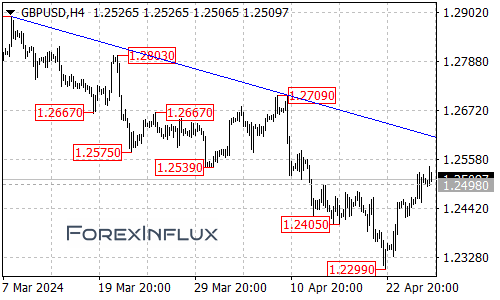

The GBPUSD currency pair has seen its bullish momentum accelerate over recent sessions, with the upside move from the 1.2299 low extending all the way up to 1.2540 so far.

With the path of least resistance still appearing to favor the topside at this stage, further GBPUSD gains could potentially be on the horizon in the coming days. The next key targets that buyers will be eyeing are the 1.2570 level followed by a potential test of the falling trendline resistance visible on the 4-hour chart, which currently resides around the 1.2610 area.

However, it’s important to note that the broader technical outlook remains bearish despite this corrective bounce higher off the 1.2299 lows. Specifically, as long as GBPUSD holds below the falling trendline resistance that has been capping rallies since the 1.2893 peak, the current upswing is likely nothing more than a counter-trend correction within the longer-term downtrend.

In this scenario, another bearish leg lower toward the 1.2300 region could potentially emerge once the corrective rebound from 1.2299 runs its course.

In the near-term, the first major support for GBPUSD has arrived at the 1.2460 level. A breakdown below this floor could see the currency pair revisiting the 1.2400 handle next. Any plunge through 1.2400 would raise serious doubts about the rally’s sustainability, likely exposing the 1.2300 area as the next key downside target.

For now, GBPUSD remains in its short-term uptrend as long as it holds above that 1.2460 support. But the broader outlook will remain bearish unless the pair can push through the falling trendline resistance around 1.2610 that has been capping rallies for a month.

Traders will want to closely monitor the price action around 1.2570, the falling trendline resistance near 1.2610, and the 1.2460/1.2400 support levels in the coming sessions. These levels will be critical in determining whether the corrective rebound off the March lows has further to go or if the larger downtrend from 1.2893 is set to potentially resume sooner rather than later.