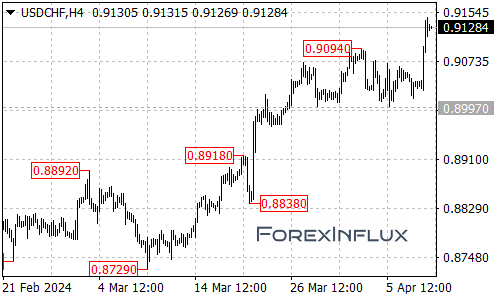

After a period of sideways consolidation within the trading range between 0.8997 and 0.9094, USDCHF has made a decisive bullish move by breaking above the 0.9094 resistance level. The pair has extended its upside from the 0.8729 low, rallying as high as 0.9146 so far. This breakout suggests that the overall uptrend in USDCHF has resumed after a brief pause.

With the breakout now confirming the bullish bias, further upside could be expected in USDCHF after a minor consolidation period. The next key target for the buyers is the psychologically important 0.9200 handle.

In the near-term, the first support area to watch is at 0.9095, which represents the former resistance zone that was just broken. As long as USDCHF holds above 0.9095, the upside momentum is expected to remain intact. Only a move back below 0.9095 would mark a bearish reversal signal and open the door for a potential pullback towards the 0.9050 area.

USDCHF traders will want to keep a close eye on whether the pair can extend its gains beyond the 0.9200 resistance zone or if profit-taking kicks in at that level. The ability (or inability) to push through 0.9200 will help determine if the larger uptrend can remain firmly established.

For now, the technical breakout above the 0.9094 resistance zone has reinstated an upside bias in USDCHF. Unless the 0.9095 support area is violated, the path of least resistance appears to be for a continuation higher in line with the resumed uptrend off the 0.8729 lows.