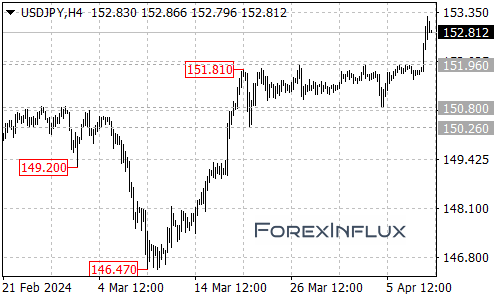

The USDJPY currency pair has seen a strong bounce higher, rallying all the way up to 153.23 so far. This move took out the 151.96 resistance level, suggesting that the broader uptrend from the 146.47 low on March 8th has resumed after a brief pause.

With momentum clearly favoring the bullish side once again, further upside could be expected in USDJPY after a minor consolidation period. The next key target for the buyers is the 155.00 handle.

In the near-term, the first support area to watch is at 152.60. As long as USDJPY holds above this level, the bias remains tilted in favor of the bulls. Only a breakdown below 152.60 would mark a bearish reversal signal and open the door for a potential pullback toward 152.00.

USDJPY traders will want to keep a close eye on whether the pair can extend its gains beyond the 155.00 resistance zone or if profit-taking kicks in at that level. The ability (or inability) to push through 155.00 will help determine if the larger uptrend can remain firmly intact.

For now, the technical breakout above 151.96 resistance has reinstated an upside bias in the USDJPY. Unless the 152.60 support area is taken out, the path of least resistance appears to be for a continuation higher in line with the resumed uptrend off the March lows.