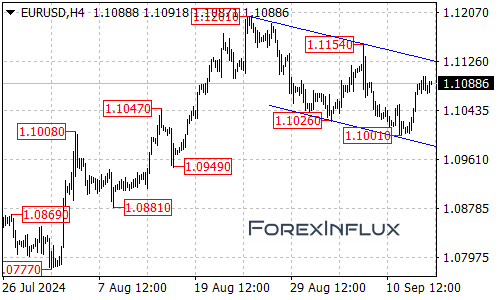

The EURUSD currency pair has recently broken above the 1.1050 resistance level, suggesting that the downward movement from 1.1154 may have concluded at 1.1001. However, it’s important to note that the pair is still constrained within a falling price channel on the 4-hour chart, which indicates a longer-term downtrend that began from 1.1201.

Current Market Outlook

As long as the channel resistance holds firm, the recent bounce from 1.1001 might simply be viewed as a consolidation phase within this downtrend. A further decline towards the 1.1000 support level remains a possibility following this period of consolidation.

Key Support Levels

- Initial Support: The first level to watch is 1.1065. If the price breaks below this, it may test the 1.1000 support again. Should this level be breached, the next support levels to consider would be 1.0960, followed by 1.0900.

Potential Upside

Conversely, if the EURUSD manages to break above the channel resistance, it would indicate that the downward movement from 1.1201 has likely ended at 1.1001. In this scenario, the next target would be around 1.1150, followed by the previous high resistance at 1.1201.