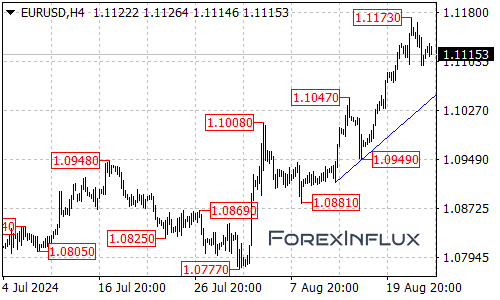

EURUSD has pulled back from its recent high of 1.1173. The pair broke below the 1.1100 support level, signaling a potential pause in the uptrend that started at 1.0777.

Short-Term Outlook:

- We might see further decline in the coming days.

- The key level to watch is the rising trend line on the 4-hour chart, which could act as support.

Big Picture View:

- As long as the price stays above the rising trend line, the overall uptrend is likely to continue.

- This suggests that what we’re seeing now might just be a temporary consolidation.

Key Levels to Watch:

- Support: The rising trend line on the 4-hour chart

- This is crucial for maintaining the current uptrend.

- A break below this line could signal that the uptrend is over.

- Resistance: 1.1173

- If the price breaks above this level, we could see another push higher.

- The next targets would be 1.1200, followed by the 1.1250 area.

What This Means for Traders:

- Short-term traders might look for potential downside moves towards the rising trend line.

- Longer-term traders should keep an eye on that trend line support. As long as it holds, the uptrend remains intact.

- Be prepared for a potential resumption of the uptrend if the price breaks above 1.1173.

Remember, forex markets can change quickly. Always use proper risk management and stay informed about market conditions.