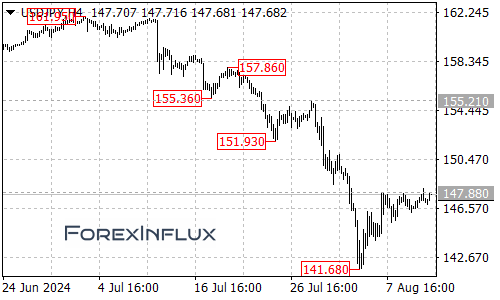

On Monday, August 12th, the US Dollar briefly surpassed 148 against the Japanese Yen before pulling back. Let’s break down the recent movements and what they might mean for traders.

Recent Developments

- Reduced Short Positions: Data from the U.S. Commodity Futures Trading Commission and the London Stock Exchange Group showed that leveraged funds have reduced their net short positions on the yen to the lowest level since February 2023.

- U.S. Economic Data: Lower-than-expected unemployment claims in the U.S. eased recession fears, providing some support for the dollar.

- Bank of Japan (BOJ) Stance: BOJ officials suggested they’re unlikely to rush into another rate hike, putting pressure on the yen.

Current Market Dynamics

The USD/JPY pair has entered a phase of adjustment over the past few trading days. However, Jane Foley, Head of FX Strategy at Rabobank in London, suggests that increased volatility might be on the horizon. She notes, “Given the potential for U.S. elections and Federal Reserve rate cuts, volatility could be higher towards the end of the year. The market is unlikely to re-engage in carry trades.”

This implies that the yen’s weakness due to carry trades might gradually diminish.

Short-Term Outlook

- Key Resistance: Watch the 148 level closely, especially before Wednesday’s U.S. CPI data release.

- Bullish Scenario: If USD/JPY breaks above 148, it could potentially challenge the 150 level.

- Bearish Scenario: If the pair consistently closes below the 148 resistance, it may continue its downward trend.

Key Takeaways for Traders

- Monitor the 148 level as a crucial resistance point.

- Keep an eye on Wednesday’s U.S. CPI data for potential market-moving news.

- Be prepared for increased volatility as we approach year-end, considering U.S. election dynamics and potential Fed policy shifts.

Remember, forex markets can change quickly. Always use proper risk management techniques and stay informed about economic events that could impact currency movements.

We’ll continue to monitor USD/JPY and provide updates as the situation evolves. Happy trading!