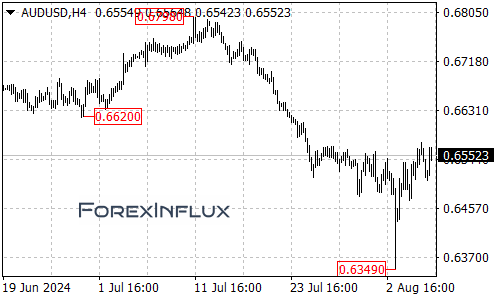

On Wednesday, August 7, the Australian dollar slipped by 0.01% against the US dollar, closing at 0.6517 USD. This modest decline erased an earlier gain of 0.85%, leaving the pair essentially flat compared to the previous day’s close.

The Australian dollar has been under pressure in recent days, following the Reserve Bank of Australia’s (RBA) decision to rule out a rate cut this year. The RBA cited expectations that core inflation would only decline slowly, which has kept the Aussie dollar struggling to gain momentum. Although the currency showed signs of stabilizing and attempting a slow recovery from its recent lows, global market turmoil on Monday pushed the AUD to its lowest level in eight months.

After the Bank of Japan’s Deputy Governor spoke on Wednesday, the Australian dollar saw a brief recovery, reaching an intraday high of 0.6574. However, the upward momentum was short-lived, and the currency faced significant selling pressure towards the close of the trading session.

Technical Outlook

- Current Trend:

- The AUD/USD pair remains in a consolidation phase near its recent lows.

- Short-Term Expectations:

- Without any major news to drive the market, the pair is likely to continue trading within a narrow range.

- The expected trading range is between 0.6440 and 0.6580.

Conclusion

The Australian dollar continues to struggle amid a mix of global economic uncertainty and domestic monetary policy signals. In the absence of significant catalysts, AUD/USD is likely to remain in a tight consolidation range, with traders closely watching for any developments that could break the current pattern.