The British Pound to US Dollar exchange rate (GBP/USD) has been on a downward trend recently. Let’s break down what’s happening and what traders should watch for in the coming days.

Recent Price Action

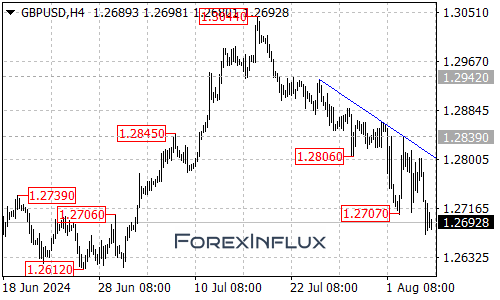

- GBP/USD has dropped from a high of 1.3044 to a low of 1.2672.

- This significant move has caught the attention of forex traders worldwide.

Technical Analysis: What the Charts Tell Us Looking at the 4-hour chart, we can see a clear falling trend line. This line is crucial for understanding the pair’s potential next moves.

Bearish Scenario: Further Downside Possible

- As long as GBP/USD stays below the falling trend line, we could see more downward movement.

- The next target for bears could be around 1.2640.

Key Levels to Watch

- Resistance: 1.2750

- This is the first hurdle for any potential recovery.

- A move above this level could signal a short-term bounce.

- Trend Line Resistance

- The falling trend line on the 4-hour chart is the most significant resistance.

- Breaking above this line would be a strong signal that the downtrend might be over.

What Traders Should Look For

- Continued Weakness: If GBP/USD remains below the trend line, look for potential shorting opportunities with a target near 1.2640.

- Potential Reversal Signs:

- Watch for a break above 1.2750. This could lead to a test of the falling trend line.

- A decisive break above the trend line could indicate that the downtrend is ending.

Key Takeaways

- The overall trend for GBP/USD is currently downward.

- 1.2640 is the next potential target if the weakness continues.

- Keep a close eye on how the pair behaves around 1.2750 and the falling trend line for any signs of a reversal.

Remember, forex markets can change quickly. Always use proper risk management and stay informed about economic events that could impact currency movements.

We’ll continue to monitor GBP/USD and provide updates as the situation evolves. Happy trading!