The Euro to US Dollar exchange rate (EUR/USD) has been showing some patterns lately. Let’s break down the current situation and what it might mean for traders in the short term.

Recent Price Action

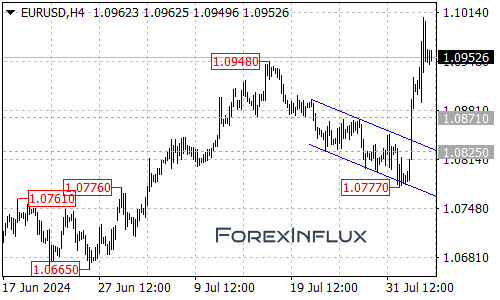

- Monday saw EUR/USD experience a dip, but it found support just above 1.0890.

- On the upside, the pair faced resistance below 1.1010.

What This Means These movements suggest that despite the recent short-term decline, EUR/USD may still maintain an overall upward trend.

Potential Scenarios

- Bullish Outlook:

- If EUR/USD stabilizes above 1.0890 today, we could see a push towards 1.1100.

- This scenario assumes the pair overcomes current resistance levels.

- Key Levels to Watch:

- Short-term resistance: 1.1010 – 1.1015

- Significant resistance: 1.1070

- Short-term support: 1.0890

- Significant support: 1.0840

Trading Implications

- Traders should pay close attention to how the pair behaves around 1.0890.

- A bounce from this level could signal a continuation of the upward trend.

- However, a break below could indicate further downside potential.

Key Takeaways

- Despite recent weakness, EUR/USD still shows potential for upward movement.

- The 1.0890 level is crucial – watch how the pair reacts around this price.

- If bullish momentum continues, 1.1100 could be the next significant target.

Remember, forex markets can be volatile, and it’s essential to use proper risk management techniques in your trading. Always stay informed about economic events that could impact currency movements.

We’ll continue to monitor EUR/USD and provide updates as the situation evolves. Happy trading!