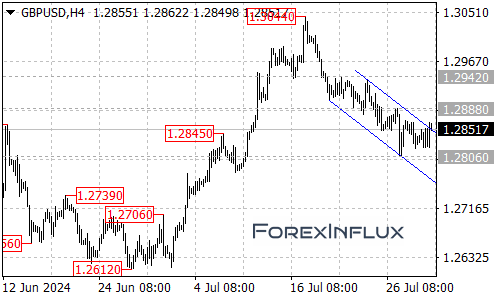

The GBPUSD pair has recently made a significant move by breaking above the top of the falling price channel visible on the 4-hour chart. This breakout suggests a potential shift in the short-term trend and opens up possibilities for further upside.

Current Technical Picture

While the breakout is a positive sign for bulls, it’s important to note that the pair is still operating within a larger downtrend from the 1.3044 level. The current price action could be interpreted as a consolidation phase within this broader downtrend.

Key Levels to Watch

Resistance Levels:

- 1.2888 (Critical resistance)

- 1.2940 area (Potential target if 1.2888 breaks)

Support Levels:

- 1.2806 (Initial support)

- 1.2780 area (Secondary support)

- 1.2710 area (Major support and potential downside target)

Potential Scenarios

Bullish Scenario

The recent channel breakout supports a short-term bullish outlook:

- We’re likely to see further rally towards the 1.2888 resistance in the coming days.

- If the price breaks above 1.2888, it would signal that the downside move from 1.3044 has likely completed at 1.2806.

- In this case, the next target would be the 1.2940 area.

This scenario could offer opportunities for traders looking to capitalize on a potential trend reversal.

Bearish Scenario

Despite the channel breakout, the larger downtrend remains a concern:

- As long as the price stays below the 1.2888 resistance, the current movement could be seen as a consolidation within the broader downtrend.

- If this is the case, we might see a decline towards the 1.2710 area after the consolidation phase.

- Key levels to watch on the downside are 1.2806 and 1.2780. A break below these could accelerate the bearish momentum.

This scenario aligns with the longer-term downtrend and suggests caution for bulls.

Conclusion

The GBPUSD pair is at a critical juncture after breaking out of the falling price channel. While this breakout is a positive sign for bulls, the 1.2888 resistance level will be crucial in determining the pair’s direction in the coming days.

Traders should watch how the pair reacts to the 1.2888 level. A break above could signal a more significant reversal, while a rejection could lead to a continuation of the larger downtrend.

As always, it’s essential to consider broader economic factors affecting both the UK and US economies, as these can significantly impact the GBPUSD pair. Stay informed about economic releases, central bank decisions, and geopolitical events, and remember to implement proper risk management in your trading strategies.