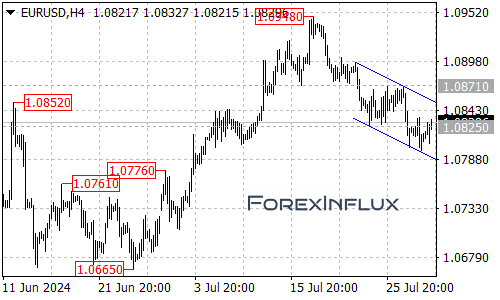

On Tuesday, the EUR/USD pair showed interesting price action. The pair found support above 1.0795 during its decline, while facing resistance below 1.0835 on upward movements. This behavior suggests that despite short-term gains, the pair may continue its overall downward trend.

Current Market Dynamics

The recent price action indicates a potential continuation of the bearish trend after a short-term upward correction. The market’s reaction to key resistance levels will be crucial in determining the short-term direction of EUR/USD.

Key Levels to Watch

Resistance Levels:

- 1.0835 (Short-term resistance)

- 1.0850 – 1.0855 (Significant short-term resistance)

Support Levels:

- 1.0790 – 1.0795 (Short-term support)

- 1.0770 (Significant short-term support)

Potential Scenarios

Bearish Scenario

If EUR/USD encounters resistance below 1.0855 today, we could see a continuation of the downward trend:

- The next target for this downward move would be 1.0770.

- A break below the short-term support at 1.0790 – 1.0795 could accelerate the bearish momentum.

This scenario aligns with the current downtrend and suggests potential opportunities for traders looking to sell on rallies.

Bullish Scenario

While not explicitly mentioned in the original analysis, it’s important to consider the potential upside:

- If the pair manages to break above the 1.0835 resistance, it could challenge the significant resistance zone at 1.0850 – 1.0855.

- A break above 1.0855 might indicate a short-term trend reversal and could lead to further gains.

However, given the current market dynamics, this scenario seems less likely in the immediate term.

Conclusion

The EUR/USD pair appears to be maintaining its downward bias, despite some short-term upward movements. The key level to watch today is the resistance around 1.0855. If the pair fails to break above this level, we could see a move towards the 1.0770 support.

Traders should pay close attention to how the pair reacts to the 1.0835 resistance and the 1.0790 – 1.0795 support zone. These levels could provide important clues about the pair’s short-term direction.

As always, it’s essential to consider broader economic factors affecting both the Eurozone and US economies, as these can significantly impact the EUR/USD pair. Stay informed about economic releases, central bank decisions, and geopolitical events, and remember to implement proper risk management in your trading strategies.