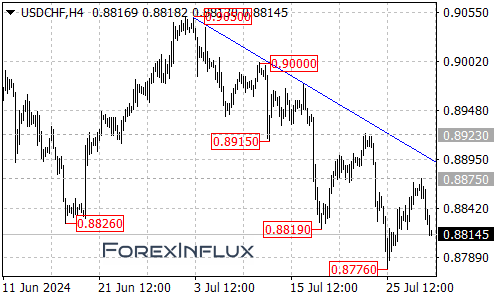

The USDCHF pair has recently shown signs of weakness, failing to break above the resistance of the falling trendline visible on the 4-hour chart. After reaching a high of 0.8875, the pair pulled back, suggesting that the downtrend from 0.9050 remains intact.

Current Technical Picture

The pair’s inability to breach the falling trendline resistance reinforces the bearish sentiment in the market. The recent bounce from 0.8776 appears to be a consolidation within the larger downtrend rather than a reversal signal.

Key Levels to Watch

Support Levels:

- 0.8776 (Immediate support)

- 0.8730 area (Potential target if support breaks)

Resistance Levels:

- 0.8875 (Recent high)

- Falling trendline on the 4-hour chart

- 0.8923 (Secondary resistance)

- 0.9000 area (Psychological resistance)

Potential Scenarios

Bearish Scenario

The current price action suggests a continuation of the downtrend:

- As long as the price remains below the falling trendline, the bearish outlook remains valid.

- We may see further decline to test the 0.8776 support level in the coming days.

- If this support breaks, it could trigger a more significant downside move towards the 0.8730 area.

This scenario aligns with the current downtrend and suggests potential opportunities for traders looking to sell on rallies.

Bullish Scenario

While less likely given the current trend, a bullish scenario is still possible:

- The key levels to watch are 0.8875 and the falling trendline on the 4-hour chart.

- A break above these levels would indicate that the downside move has completed.

- In this case, we could see a move towards the next resistance level at 0.8923, and potentially the 0.9000 area if bullish momentum builds.

However, it’s important to note that this scenario would require a significant shift in market sentiment and potentially supportive fundamental factors.

Conclusion

The USDCHF pair appears to be maintaining its downward trajectory, with the recent failure to break above the falling trendline reinforcing the bearish outlook. The bounce from 0.8776 is currently viewed as a consolidation within the larger downtrend rather than a reversal.

Traders should keep a close eye on the 0.8776 support level in the near term. A break below this level could open the door for further declines towards the 0.8730 area. On the other hand, only a decisive break above 0.8875 and the falling trendline would signal a potential trend reversal, but this seems less likely in the current market conditions.

As always, it’s crucial to consider broader economic factors affecting both the US and Swiss economies, as these can have significant impacts on the USDCHF pair. Stay informed about economic releases, central bank decisions, and geopolitical events, and remember to implement proper risk management in your trading strategies.