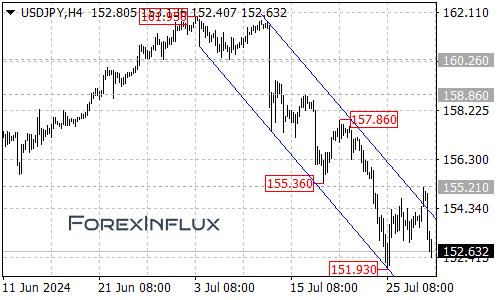

The USDJPY pair has shown interesting price action recently. After breaking above the top of the falling price channel visible on the 4-hour chart, the pair encountered resistance at 155.21. Subsequently, it dropped to 152.41, suggesting that the overall downtrend from 161.95 remains intact.

Current Technical Picture

Despite the brief breakout above the price channel, the pair’s inability to sustain gains above 155.21 indicates that bearish pressure still dominates the market sentiment.

Key Levels to Watch

Support Levels:

- 151.93 (Immediate support)

- 150.90 (Secondary support)

- 150.00 area (Psychological support level)

Resistance Levels:

- 155.21 (Key resistance)

- 155.80 (Potential target if resistance breaks)

- 158.00 area (Secondary target in case of continued upside)

Potential Scenarios

Bearish Scenario

The current price action suggests a continuation of the downtrend:

- We may see further decline to test the 151.93 support level later today.

- If this support breaks, it could trigger a more significant downside move.

- In this case, the next targets would be 150.90, followed by the psychologically important 150.00 area.

This scenario aligns with the current downtrend and suggests potential opportunities for traders looking to sell on rallies.

Bullish Scenario

While less likely given the current trend, a bullish scenario is still possible:

- The key level to watch is the 155.21 resistance.

- A break above this level would indicate that the downside move from 161.95 has completed.

- In this case, we could see a move towards 155.80, and potentially the 158.00 area if bullish momentum builds.

However, it’s important to note that this scenario would require a significant shift in market sentiment and potentially supportive fundamental factors.

Conclusion

The USDJPY pair appears to be maintaining its downward trajectory, despite a brief breakout attempt. The rejection at 155.21 and subsequent drop reinforces the bearish sentiment in the market.

Traders should keep a close eye on the 151.93 support level in the near term. A break below this level could open the door for further declines towards 150.90 and potentially the 150.00 area. On the other hand, only a decisive break above 155.21 would signal a potential trend reversal, but this seems less likely in the current market conditions.

As always, it’s crucial to consider broader economic factors affecting both the US and Japanese economies, as these can have significant impacts on the USDJPY pair. Stay informed about economic releases, central bank decisions, and geopolitical events, and remember to implement proper risk management in your trading strategies.