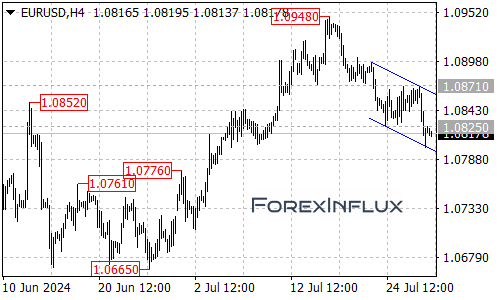

The EURUSD pair has recently experienced a significant downward move, breaking below the key 1.0825 support level after failing to breach the 1.0870 resistance. This bearish momentum has extended the decline from the previous high of 1.0948, pushing the pair to a new low of 1.0802.

Current Technical Picture

The pair has now reached the bottom of a falling price channel visible on the 4-hour chart. This positioning within the channel is crucial for understanding potential near-term movements.

Key Levels to Watch

Support Levels:

- 1.0802 (Recent low)

- 1.0770 (Next potential target)

- 1.0725 area (Secondary target)

Resistance Levels:

- Top of the price channel

- 1.0870 (Key resistance level)

- 1.0948 (Previous high)

Potential Scenarios

Short-term Bullish Scenario

Given that EURUSD has reached the bottom of the falling price channel, we might expect a rebound in the coming days:

- The initial target for this rebound would likely be the top of the channel.

- This potential upward move could provide short-term trading opportunities.

However, it’s important to note that this rebound may be temporary if the overall downtrend remains intact.

Continued Bearish Scenario

If the price fails to break above the channel resistance after the rebound:

- The downside move is expected to resume.

- The next target to watch would be around 1.0770.

- If bearish momentum persists, we could see a further drop towards the 1.0725 area.

This scenario assumes that the overall downtrend remains the dominant force in the market.

Potential Trend Reversal

A more significant bullish move could occur if EURUSD manages to break above the channel resistance:

- Such a breakout could drive the price towards the key resistance level at 1.0870.

- A break above 1.0870 would suggest that the recent downside move has completed.

- In this case, we might see another rise towards the previous high of 1.0948.

This scenario would indicate a major shift in market sentiment and could signal the start of a new uptrend.

Conclusion

The EURUSD pair is at a critical juncture after its recent breakdown below 1.0825. While a short-term rebound is possible due to the pair reaching the bottom of its price channel, the overall trend remains bearish for now.

Traders should watch for how the pair reacts to the top of the channel in the coming days. A failure to break this resistance could lead to further declines, while a successful breakout might signal a more significant reversal.

As always, it’s crucial to consider broader economic factors affecting both the Eurozone and US economies, as these can significantly impact the EURUSD pair. Stay informed about economic releases, central bank decisions, and geopolitical events, and remember to implement proper risk management in your trading strategies.