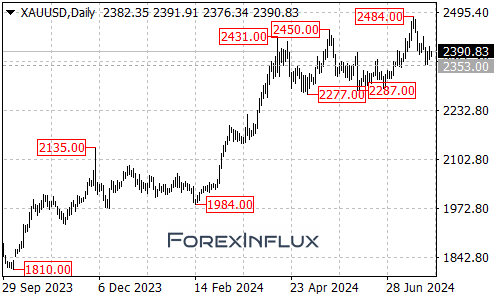

Gold has shown price action recently, with support emerging at $2,369 during Monday’s dip and resistance encountered below $2,403 on the upside. This price behavior suggests that gold may maintain its upward trajectory despite short-term fluctuations.

Current Market Dynamics

The precious metal appears to be in a phase where it’s testing both support and resistance levels. The market’s reaction to these levels will be crucial in determining the short-term direction of gold prices.

Key Levels to Watch

Support Levels:

- $2,365 – $2,366 (Short-term support)

- $2,350 – $2,351 (Significant short-term support)

Resistance Levels:

- $2,398 – $2,399 (Short-term resistance)

- $2,417 – $2,418 (Significant short-term resistance)

Potential Scenarios

Bullish Scenario

If gold manages to stabilize above $2,365 today, we could see a continuation of the upward trend. In this case:

- The next target range would be between $2,399 and $2,418.

- A break above the short-term resistance at $2,398 – $2,399 could signal stronger bullish momentum.

This scenario suggests that the overall uptrend remains intact despite recent price fluctuations.

Bearish Scenario

While not explicitly mentioned in the original analysis, it’s important to consider the potential downside:

- If gold fails to hold above the $2,365 – $2,366 support level, we might see increased selling pressure.

- A drop below the significant short-term support at $2,350 – $2,351 could indicate a shift in short-term market sentiment.

Conclusion

Gold prices are currently navigating a series of short-term support and resistance levels. The market’s reaction to these levels, particularly the $2,365 support and the $2,398 – $2,399 resistance range, will be crucial in determining the short-term direction.

Traders and investors should keep a close eye on these key levels. A stabilization above $2,365 could pave the way for further gains, potentially targeting the $2,399 – $2,418 range. However, it’s also important to be aware of the potential for downside movements if support levels don’t hold.

As always, it’s essential to consider broader economic factors, geopolitical events, and changes in currency values, as these can significantly impact gold prices. Stay informed about global economic indicators and implement proper risk management in your trading or investment strategies.