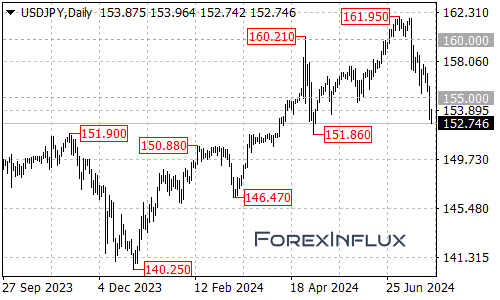

The daily chart for USD/JPY reveals that the yen has recently made significant progress, driven by a weaker dollar and potential intervention by Japanese officials. The market was caught off guard by Japan’s sudden large-scale yen purchases following positive news such as lower-than-expected US inflation. This is in stark contrast to previous large-scale yen purchases, which typically occurred after negative news, like higher-than-expected US inflation or economic growth.

Technical Analysis

- Recent Movements:

- A short-term bearish reversal on the daily chart has materialized, leading to a downward trend.

- The pair has broken through significant support levels at 160.00 and 155.00 during its descent.

- Potential Influences:

- If US inflation data surprises to the downside, this week’s Personal Consumption Expenditures (PCE) data could continue to support this downward trend.

- If the data meets expectations, the downtrend may continue at a slower pace.

- Support Levels:

- The next key support levels to watch are 151.90 and 150.00.

Conclusion

The USD/JPY pair is currently experiencing a downward trend influenced by a weaker dollar and potential intervention by Japanese officials. Key support levels and upcoming US inflation data will be critical in determining the pair’s future direction. Traders should stay alert to these developments to make informed decisions.