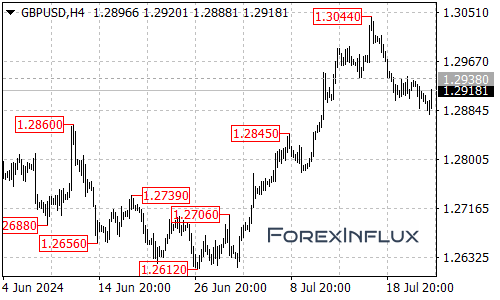

After a strong two-week rally, the GBP/USD currency pair reached a high of 1.3044 last Wednesday, marking its highest point since late July of last year. However, the pair has since pulled back to around the 1.29 level as the U.S. dollar index rebounded.

The recent movements of the pound are primarily influenced by three factors: UK economic data, the Bank of England’s monetary policy, and the performance of the U.S. dollar.

In terms of economic data, the UK recently released inflation and employment figures that generally met market expectations. However, the latest retail sales data was disappointing, with June’s adjusted retail sales showing a month-on-month decline of 1.2%. This figure was significantly lower than the previous value of 2.9% and the expected 0.4%, which negatively impacted the pound’s performance.

Regarding monetary policy, the UK’s Consumer Price Index (CPI) remains at 2%, indicating persistent inflation. With strong wage growth and a sticky inflation rate, the market has pushed back its expectations for a potential rate cut by the Bank of England from August to September. This delay in rate cuts could be supportive for the pound.

On the U.S. side, this week will see the release of key economic data, including the preliminary GDP growth rate for the second quarter, June’s PCE, and July’s PMI. If the market anticipates a rate cut by the Federal Reserve, there could be further upward movement for the GBP/USD pair.

Looking ahead, I believe that due to the interplay of these factors, the pound may enter a phase of high-level consolidation. From a technical perspective, after failing to hold above the 1.30 mark, the GBP/USD has retraced. The resistance level is now seen at 1.3020, while support is at 1.2850.

In summary, while the pound has faced some challenges recently, it remains influenced by various economic factors that could shape its future movements. Keep an eye on these key levels and economic indicators as we move forward!