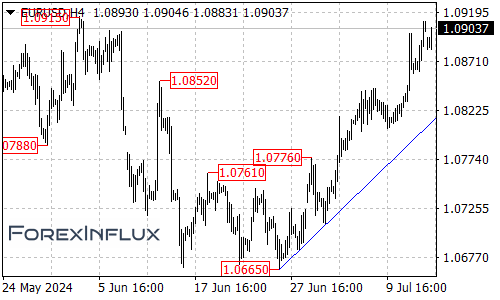

The euro has been on a upward trend against the US dollar recently, climbing from around 1.07 to touch a high of 1.0911 last week – its highest level since June 7. This rebound comes as US economic data weakens and inflation continues to cool down.

However, the eurozone isn’t without its own challenges. The latest Investor Confidence Index for July came in at -7.3, falling short of both expectations (0) and the previous reading (0.3). This suggests that despite the euro’s recent strength, the region’s economy remains somewhat fragile.

So what’s driving the euro’s performance? Here are a few key factors:

- US Economic Weakness: As the US economy shows signs of slowing down and inflation pressures ease, markets are increasingly betting on potential interest rate cuts by the Federal Reserve. This has provided some support for the euro.

- ECB Policy Stance: Some European Central Bank (ECB) officials have been cautious about further rate hikes, hinting that another increase in July is unlikely. Markets expect the ECB to keep rates steady at its upcoming meeting, with less than two rate cuts predicted for the year.

- Rate Cut Expectations: While markets are pricing in the possibility of three Fed rate cuts this year, the ECB is expected to be more conservative in its approach. This divergence in policy expectations could continue to bolster the euro.

From a technical perspective, the EUR/USD pair has returned to the 1.09 level. However, it may face resistance around the recent high of 1.0916. If it fails to break through this level, we could see a pullback.

In conclusion, while the euro has made gains against the dollar, its further upside potential may be limited given the eurozone’s own economic challenges. Investors should keep a close eye on upcoming economic data and central bank communications for clues about future currency movements.