On Friday, July 12th, the USD/JPY pair continued its downward trend from Thursday, closing 0.56% lower at 157.91 in New York trading. The pair touched a low of 157.30, its lowest level since June 17th.

Key Factors Driving the Trend

- Weak US CPI Data:

- Thursday’s softer-than-expected US Consumer Price Index (CPI) data weakened the dollar across the board.

- Suspected Japanese Intervention:

- Market sources suggest that Japanese authorities intervened in the currency market, taking advantage of the dollar’s weakness following the CPI release.

- The reported intervention amount was approximately 3.57 trillion yen ($22.43 billion), less than three months after the previous intervention.

- Continued Pressure:

- Friday’s movement might be a result of continued intervention or currency checks by Japanese authorities.

Long-term Outlook for the Yen

To significantly change the yen’s trajectory, more substantial measures may be needed:

- Potential actions by the Bank of Japan (BoJ) could include:

- Stopping bond purchases

- Implementing a significant rate hike at the late July meeting

- Without decisive action, a sustained yen recovery may be challenging.

Technical Analysis

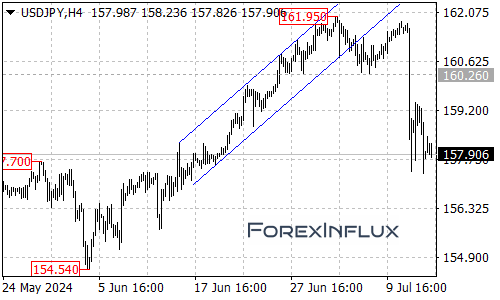

4-hour Chart:

- Two consecutive days of bearish candles indicate increased selling pressure on USD/JPY.

- Support was found near 157 on both Thursday and Friday, suggesting some buying interest at lower levels.

Key Levels to Watch:

- Support: 157 (If broken, next target is 155-153 range)

- Resistance: 162 (Currently forming a significant barrier)

Outlook for Traders

- The USD/JPY pair is at a critical juncture, with potential for further downside if support at 157 breaks.

- Keep an eye on any signs of continued intervention by Japanese authorities.

- Watch for any signals from the BoJ regarding potential policy shifts at their upcoming meeting.

- US economic data releases will continue to play a crucial role in the pair’s movement.

Remember, currency interventions can cause sudden and significant market movements. Always use proper risk management techniques when trading, especially during periods of heightened volatility. Stay informed about economic releases and central bank communications from both the US and Japan.