On Tuesday, July 9th, the USD/JPY pair rose 0.29% to 161.28, maintaining levels just below the 38-year high of 161.96 reached last week.

Key Factors Influencing the Market

- Fed Chair Powell’s Congressional Testimony:

- Powell stated that inflation remains “above” the Fed’s 2% target but has been improving in recent months.

- He suggested that “more good data would strengthen” the case for rate cuts.

- Powell noted that the job market has cooled and added, “We now face risks on both sides,” indicating a shift from solely focusing on inflation.

- However, Powell didn’t provide the dovish economic outlook some market participants were hoping for, nor did he give a clear timeline for rate cuts.

- Bank of Japan (BoJ) Developments:

- The BoJ is expected to announce a quantitative tightening plan at its policy meeting at the end of the month.

- On Tuesday, the BoJ released a summary of opinions from a survey of bond market participants regarding how the central bank should reduce its massive bond purchases.

- If the BoJ significantly reduces its bond purchases at the upcoming meeting, it could provide some support for the yen.

- Upcoming U.S. CPI Data:

- Thursday’s U.S. CPI data release is currently the market’s main focus.

- This data could be a key factor in determining future U.S. interest rates and USD/JPY trends.

Technical Analysis

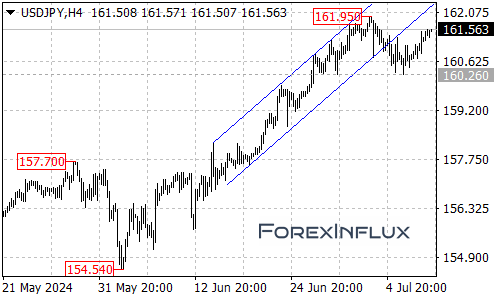

4-hour Chart:

- The USD/JPY pair is maintaining support above 160.26, indicating that dollar bulls haven’t shown signs of retreating yet.

- However, there’s significant short-term resistance around the 162 level.

Potential Scenarios

- If Thursday’s U.S. inflation data remains strong:

- This could push the USD/JPY pair to new recent highs.

- If inflation data is weaker than expected:

- We might see a profit-taking adjustment in USD/JPY.

Key Takeaways for Traders

- The USD/JPY pair remains near multi-decade highs, supported by diverging monetary policies.

- Keep a close eye on Thursday’s U.S. CPI data release, as it could significantly impact the pair’s direction.

- Watch for any signals from the BoJ regarding potential policy shifts at their upcoming meeting.

- While the uptrend remains intact, be aware of potential resistance around the 162 level.

Remember, forex markets can be volatile, especially around key economic data releases. Always use proper risk management techniques when trading, and stay informed about relevant economic news and central bank communications.