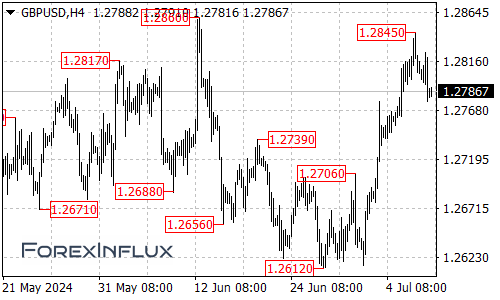

The GBP/USD pair has shown impressive strength lately, climbing from a low of 1.2612 to reach a high of 1.2845. This upward movement has brought the pair close to a significant resistance level at 1.2860. Let’s break down the current situation and potential scenarios.

Current Market Situation

- Consolidation Phase:

- The recent pullback from 1.2845 suggests we might be entering a consolidation period.

- Expected trading range: Between 1.2740 and 1.2845 in the coming days.

- Overall Trend:

- The upward trend remains intact as long as the 1.2740 support holds.

- After consolidation, we could see another push towards the 1.2860 resistance.

Key Levels to Watch

Resistance Levels:

- Initial: 1.2825

- A break above could trigger a move towards 1.2845

- Major: 1.2860

- If broken, the next target would be 1.2900

Support Levels:

- Initial: 1.2760

- Secondary: 1.2740

- This is a crucial level for maintaining the current uptrend

- If 1.2740 breaks: Watch for potential moves towards 1.2710

Potential Scenarios

Bullish Scenario:

- If 1.2740 support holds, expect the upward trend to continue.

- Watch for a break above 1.2825, which could signal a move towards 1.2845 and potentially 1.2860.

Bearish Scenario:

- A break below 1.2740 could trigger a deeper pullback.

- Next support levels to watch would be 1.2710.

Key Takeaways for Traders

- The overall trend remains bullish, but we’re likely entering a consolidation phase.

- 1.2740 is a crucial support level to watch for maintaining the uptrend.

- A break above 1.2825 could signal the next leg up in the rally.

- Always use proper risk management techniques, especially during consolidation periods when false breakouts can occur.

Remember, the GBP/USD pair can be influenced by a variety of factors, including economic data from both the UK and US, central bank policies, and global market sentiment. Stay informed about upcoming economic releases and geopolitical events that could impact the pair’s movements.