Recent Performance and Outlook

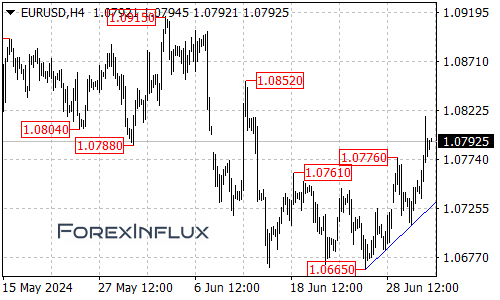

The EUR/USD pair has been showing impressive strength lately, climbing from a low of 1.0665 to reach a high of 1.0816. This upward movement has caught the attention of many traders and investors. Let’s break down the current situation and potential future scenarios.

Bullish Scenario

- Short-term outlook:

- The pair may experience a brief consolidation period

- After this, further upward movement is possible

- Key resistance levels to watch:

- First target: 1.0850 area

- If broken, next resistance at 1.0915

What to Watch for Continued Bullish Momentum

Keep an eye on how the pair behaves around the 1.0850 level. A clean break above this could signal strong bullish sentiment and potentially push the pair towards the 1.0915 resistance.

Bearish Scenario and Support Levels

While the current trend is bullish, it’s important to be aware of potential downsides:

- Initial support: 1.0775

- A break below this level could lead to a test of the rising trend line support (visible on the 4-hour chart)

- Critical level: Rising trend line support

- If this is broken, it might indicate the end of the upward move from 1.0665

- In this case, we could see a move back down to the 1.0665 support level

Key Takeaways for Traders

- The overall trend is currently bullish, with potential for further gains

- Watch for a break above 1.0850 for confirmation of continued upward momentum

- Be cautious of a potential reversal if the price drops below 1.0775 and the rising trend line support

Remember to always use proper risk management techniques and stay informed about economic news that could impact currency movements. This analysis provides a framework, but market conditions can change rapidly.