Today’s EUR/USD Market Overview

The EUR/USD pair is showing interesting movements today. Let’s break down the key points:

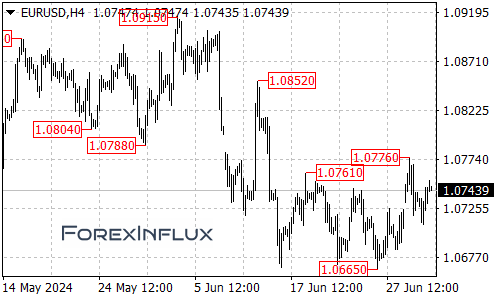

- Support and Resistance Levels:

- Support found: Above 1.0710

- Resistance encountered: Below 1.0750

- Short-term Outlook: Despite the recent dip, there’s potential for an upward trend. Here’s what to watch:

- Key support level: 1.0715 If the pair stabilizes above this level today, we could see a bullish move.

- Potential targets if bullish: Look for movement between 1.0760 and 1.0770

- Today’s Important Levels to Watch: Short-term resistance levels:

- Minor: 1.0755 to 1.0760

- Significant: 1.0765 to 1.0770

- Minor: 1.0715 to 1.0720

- Significant: 1.0695 to 1.0700

Retail Sentiment Analysis

Recent retail trading data provides additional insights:

- Long positions: 57.14% of traders are holding long positions on EUR/USD

- Long/Short ratio: 1.33 (more longs than shorts)

- Changes in positions:

- Long positions: Increased by 26.08% since yesterday, up 6.42% from last week

- Short positions: Decreased by 18.26% since yesterday, down 15.81% from last week

Interpretation of Sentiment Data

As we often take a contrarian view to crowd sentiment, the current dominance of long positions suggests that EUR/USD prices may continue to fall. The combination of current sentiment and recent changes strengthens our bearish outlook for EUR/USD.

Conclusion

While technical levels suggest potential for upward movement if key support holds, sentiment analysis points towards a possible downward trend. Traders should remain cautious and consider both technical and sentiment factors in their decision-making process.

Remember, always use proper risk management techniques and stay informed about economic news that could impact currency movements.