Recent Developments in USD/JPY

The USD/JPY pair has been making headlines with its recent performance:

- Closing price: 161.48 in New York, up 0.4%

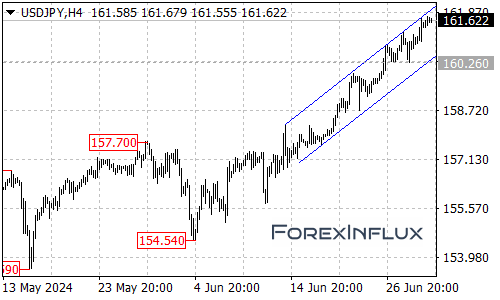

- Intraday high: 161.72, the strongest level since 1986

- Year-to-date performance: Yen has depreciated over 12% against the USD

Key Factors Driving the Yen’s Weakness

- U.S. Bond Yields:

- The primary driver behind the yen’s decline is the significant rise in U.S. long-term bond yields

- Japanese Economic Indicators:

- A recent survey showed the confidence index for large non-manufacturing firms in Japan dropped from +34 in March to +33 in June, the first deterioration in two years

- This overshadowed the improvement in the manufacturing sector, where the index rose from +11 in March to +13 in June (highest since March 2022)

- These mixed signals add uncertainty to the Bank of Japan’s future monetary policy decisions

- Interest Rate Differentials:

- The stark difference in interest rates between the U.S. and Japan continues to push USD/JPY higher

Market Implications and Future Outlook

- Potential for Intervention:

- Even if Japan intervenes in the currency market, traders may view it as an opportunity to buy more dollars

- Technical Analysis:

- As USD/JPY moves further above the 160 level, which was previously seen as a warning threshold, there’s a possibility of rapid upward movement

- Economic Growth Concerns:

- Weaker-than-expected economic data from Japan increases uncertainty about the Bank of Japan’s next moves regarding interest rates

Looking Ahead

The yen’s continued weakness against the dollar presents both opportunities and risks for investors and the Japanese economy. Key points to watch:

- Further movements in U.S. bond yields

- Bank of Japan’s monetary policy decisions

- Any potential currency market interventions by Japanese authorities

- Upcoming economic indicators from both the U.S. and Japan

Investors and traders should remain cautious and monitor these factors closely, as the currency pair could see increased volatility in the near term.