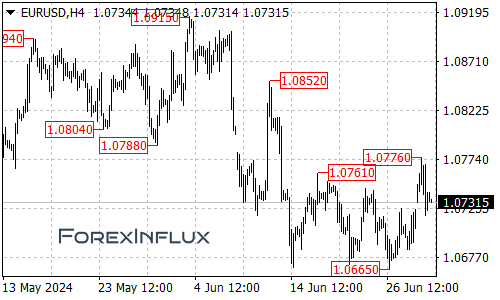

Overview of June’s EUR/USD Performance

The EUR/USD pair experienced a downward trend in June, largely influenced by a strengthening US dollar. Key points:

- The pair briefly dipped below the 1.07 mark

- Closed at 1.0714 on the last trading day of June

Economic Indicators

- Eurozone Manufacturing PMI:

- June figure: 45.6

- This was below both expectations and previous values

- Represents a 6-month low

- Economic Recovery:

- While the Eurozone showed signs of recovery in Q1 2023, recent data suggests this momentum is slowing

- Economic uncertainty is on the rise

- France, the second-largest Eurozone economy, is underperforming, significantly impacting the overall Eurozone economy

Monetary Policy Developments

- European Central Bank (ECB):

- Initiated rate cuts in June, ahead of the US Federal Reserve

- Predictions suggest the ECB may implement more frequent and larger rate cuts compared to the Fed

- Policy Divergence:

- The difference in rate cut expectations between the ECB and Fed could potentially suppress the euro’s performance

Technical Analysis

- This week saw a doji candlestick pattern

- Daily chart shows oscillation in the bearish zone

- Overall trend remains downward

Looking Ahead

- Key Factors to Watch:

- Relative economic performance of the US and Eurozone

- Monetary policy adjustments by both central banks

- Important Upcoming Data:

- PMI figures for both the Eurozone and the US

- Short-term Outlook:

- The euro may continue to show weakness and volatility

In conclusion, the EUR/USD pair faces challenges due to economic uncertainties in the Eurozone and potential policy divergences between the ECB and Fed. Traders and investors should keep a close eye on upcoming economic indicators and central bank decisions to gauge the pair’s future movements.