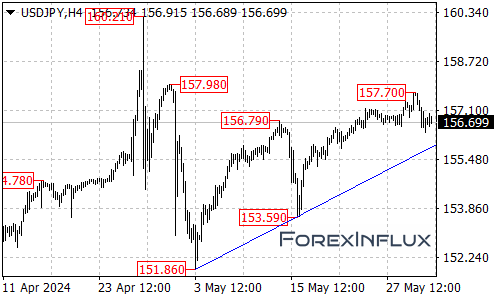

The USDJPY currency pair has been on an impressive upward trajectory, extending its rally from 151.86 to a high of 157.70. However, the subsequent pullback suggests that a consolidation phase for the uptrend that began from 151.86 is currently underway.

Potential for Further Declines Traders should brace for the possibility of deeper declines in the coming days, with the target being the rising trendline on the 4-hour chart. This trendline support will be a crucial level to watch, as it could determine the pair’s next directional move.

Bullish Outlook Remains Intact Despite the potential for further consolidation, the overall bullish outlook for the USDJPY remains intact as long as the rising trendline support holds. In such a scenario, another rise could be expected after the current consolidation phase concludes.

Key Resistance Levels On the upside, the initial resistance level for the USDJPY is situated at 157.20. A break above this level could trigger another rally, potentially leading to a test of the 158.00 resistance zone.

If the pair manages to surpass the 158.00 resistance, the next target for buyers would be the 159.00 area.

Potential Bearish Scenario However, traders should also be prepared for a potential bearish scenario. A breakthrough of the rising trendline support would indicate that the upside move from 151.86 has completed at 157.70.

In such a case, the subsequent downside move could take the USDJPY towards the 154.50 area.

In summary, while the USDJPY is currently experiencing a consolidation phase after a strong rally, the overall uptrend remains intact as long as the rising trendline support holds. Traders should monitor the mentioned resistance levels for potential upside opportunities and be cautious of a potential bearish reversal if the trendline support is breached.