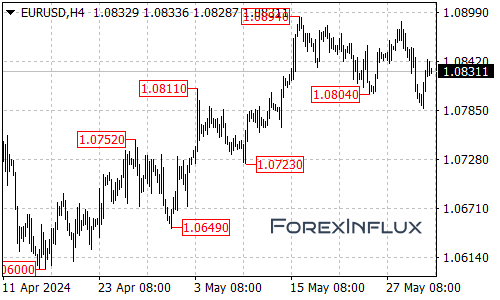

The EURUSD currency pair has recently broken below the 1.0804 support level, suggesting that the upside move from 1.0600 to 1.0894 has likely completed. This bearish breakdown signals the potential for further declines in the coming days.

Downside Targets in Focus With the bearish momentum in place, the next target for the EURUSD is around the 1.0760 level, followed by the 1.0700 area. Traders should monitor these key support zones for potential buying opportunities.

Correction Within a Larger Uptrend Despite the current downside move, it’s important to note that the fall from the 1.0894 high is likely a correction within the broader uptrend that began from the 1.0600 level. This suggests that another rise towards the 1.1000 handle could still be on the cards after the correction phase completes.

Potential Resistance Levels On the upside, the initial resistance level for the EURUSD is situated at 1.0855. A break above this level could trigger further upside momentum, potentially leading to a retest of the previous high at 1.0894.

If the pair manages to surpass the 1.0894 resistance, the next targets for buyers would be 1.0940, followed by the psychologically significant 1.1000 level.

In summary, while the EURUSD has recently broken below support, suggesting further declines towards 1.0760 and 1.0700, traders should keep in mind that this could be a corrective move within a larger uptrend. As such, the potential for another rally towards 1.1000 remains a possibility after the current pullback phase concludes.