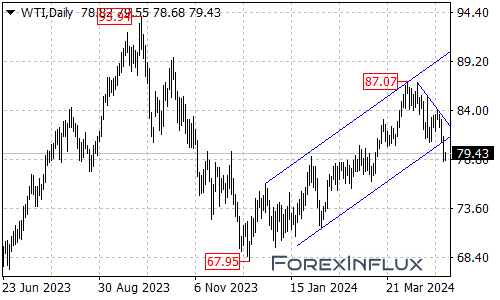

The West Texas Intermediate (WTI) crude oil futures contract has witnessed a significant bearish development, breaking below the bottom of the rising price channel on the daily chart. This breakdown suggests that the upside move from the $67.95 level has likely completed at the $87.07 high.

With this bearish signal, further declines in WTI could be on the horizon in the coming days. The next target for the bears is the $76.00 area, which could act as a potential support zone. However, if the selling pressure persists and WTI breaches this level, it could potentially trigger a more substantial downside move towards the $70.50 area.

On the upside, the initial resistance for WTI is currently situated at $80.00. If the commodity manages to regain strength and break above this level, it could potentially pave the way for a move back towards the falling trend line on the daily chart.

However, it’s important to note that a sustained recovery and a potential continuation of the previous uptrend would require WTI to decisively break above the falling trend line resistance on the daily chart. Only a convincing breakout above this critical level could potentially trigger another rally towards the $90.00 target.

In summary, the WTI crude oil futures contract has broken through a significant support level, suggesting that the recent upside move may have concluded. The commodity is now facing potential downside risks, with the $76.00 and $70.50 areas serving as the next targets for the bears. On the upside, the $80.00 level could act as an initial resistance, while a break above the falling trend line on the daily chart would be required to revive the bullish outlook and potentially pave the way for a move towards the $90.00 target.

Traders and investors are advised to closely monitor the price action around these key levels to gauge the potential direction of WTI in the coming days.