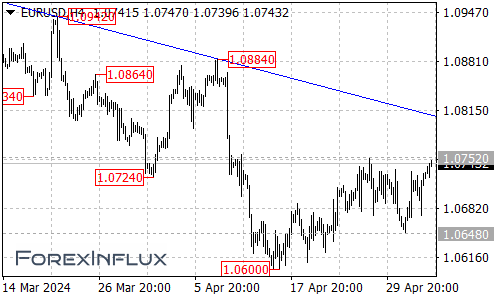

The EUR/USD currency pair is currently facing resistance at the 1.0752 level. A decisive break above this level could potentially trigger further upside momentum, potentially paving the way for a move towards the falling trend line on the 4-hour chart.

However, it’s important to note that as long as the falling trend line resistance holds firm, the recent bounce from the 1.0600 level could be viewed as a corrective move within the broader downtrend that commenced from the 1.0981 high. In this scenario, another decline towards the 1.0600 level cannot be ruled out after the current correction phase.

On the downside, the initial support for the EUR/USD is situated at the 1.0690 level. If the pair fails to hold above this support, it could potentially lead to a breakdown towards the next support level at 1.0648.

Should the EUR/USD breach the 1.0648 support, the focus would shift towards the crucial 1.0600 level, followed by the 1.0500 area. A sustained move below these levels could potentially solidify the bearish outlook and potentially pave the way for a continuation of the broader downtrend.

In summary, the EUR/USD is currently testing the 1.0752 resistance level. A breakout above this level could potentially fuel further upside momentum, potentially targeting the falling trend line resistance on the 4-hour chart. However, if the trend line resistance holds firm, the recent bounce could be viewed as a corrective move within the broader downtrend, potentially leading to another decline towards the 1.0600 and 1.0500 levels.

Traders and investors are advised to closely monitor the price action around these key levels to gauge the potential direction of the EUR/USD in the coming days.