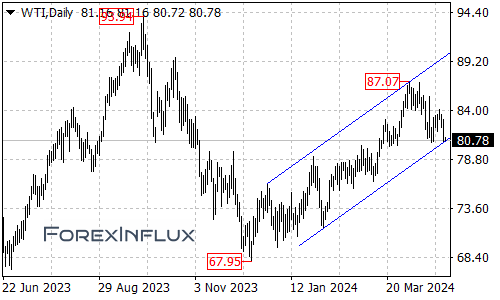

The West Texas Intermediate (WTI) crude oil futures contract is currently facing a critical support level, represented by the bottom of a rising price channel on the daily chart. This channel has been a significant guiding force for the recent uptrend, which commenced from the $67.95 level.

As long as the price respects the channel’s lower boundary and maintains its position above this support, the pullback from the $87.07 high could be viewed as a consolidation phase within the broader uptrend. In such a scenario, another rally towards the psychologically important $90.00 level remains a distinct possibility after the current consolidation phase concludes.

However, traders should also be mindful of the potential bearish implications of a breakdown below the channel support. If the WTI futures contract decisively breaches this critical level, it could signal that the upside move from $67.95 has likely completed at the $87.07 high.

In the event of such a bearish development, the next target for the bears would be the $76.00 area, followed by the $70.50 zone. A sustained move below these levels could potentially solidify a broader downtrend in the commodity.

In summary, the WTI crude oil futures contract is at a pivotal juncture, with the support of the rising price channel on the daily chart acting as a key level to watch. A successful defense of this support could pave the way for a continuation of the uptrend and a potential move towards the $90.00 target. Conversely, a breakdown below the channel support could invalidate the bullish outlook and potentially trigger a more significant correction, with the $76.00 and $70.50 areas serving as potential downside targets.