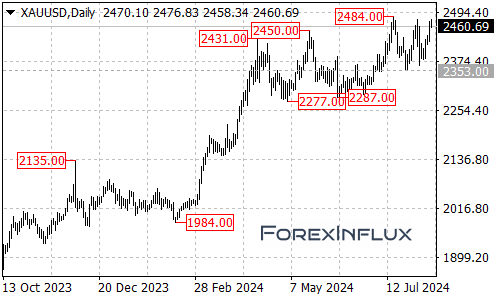

Current Situation Gold is testing a key resistance level at $2,484 per ounce. This level could determine the precious metal’s direction in the short term.

Potential Bullish Scenario If gold breaks above $2,484, it could signal a continuation of the uptrend that began on October 6, 2023, at $1,810. Here’s what to watch for:

- Breakout Target: $2,550 This would be the next major target if we see a decisive move above $2,484.

What This Means for Bulls: A break above $2,484 could be a good entry point for long positions, with stops potentially placed below the breakout level.

Potential Bearish Scenario If the $2,484 resistance holds, we could see some downward pressure. Key levels to monitor:

- Initial Support: $2,435 A drop below this level could trigger further selling.

- Range-Bound Movement: If $2,435 breaks, gold might return to trading within a range between $2,353 and $2,484.

- Lower Support: $2,353 This could be the ultimate target if bearish momentum picks up.

What This Means for Bears: A failure to break $2,484 and a subsequent drop below $2,435 could offer short-selling opportunities, at least for a move back towards the lower end of the range.

Key Takeaways for Traders

- The $2,484 level is crucial. Watch how gold behaves around this price.

- Have a plan for both bullish and bearish scenarios.

- Key levels to remember:

- Upside target: $2,550

- Key support: $2,435

- Lower range support: $2,353

Remember, precious metals markets can be volatile. Always use proper risk management techniques and stay informed about economic events and geopolitical factors that could impact gold prices.

We’ll continue to monitor XAU/USD and provide updates as the situation evolves. Happy trading!