The USD/JPY currency pair has been on quite a journey lately, and traders are keeping a close eye on its next moves. Let’s break down the recent price action and potential scenarios for this important forex pair.

Recent Price Movements

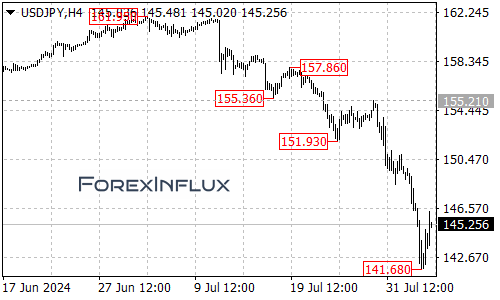

- Downward Trend: USDJPY recently experienced a significant drop, falling from a high of 161.95 all the way down to 141.68.

- Bounce Back: After hitting that low, the pair bounced back up to 146.36, suggesting we might be entering a period of consolidation.

What to Expect in the Coming Days

It looks like we’re in for some range-bound trading. Here’s what to watch for:

- Trading Range: Expect the pair to move between 141.68 and 147.70 in the short term.

- Key Resistance: 147.70 is the level to watch. If the price stays below this, we could see another move down.

- Potential Target: If the downward trend resumes, we might see USDJPY push towards the 140.00 mark.

Bullish Scenario

While the overall trend has been downward, there’s always the possibility of a reversal. Here’s what could signal a change in direction:

- Breakout Level: If USDJPY manages to break above 147.70, it could indicate that the downward move has run its course.

- Next Target: In this case, traders would likely set their sights on the 150.00 level.

Key Takeaways for Traders

- Stay alert: The market is in a consolidation phase, which means we could see movement in either direction.

- Watch the resistance: Keep an eye on how the pair behaves around the 147.70 level.

- Be prepared for both scenarios: While the overall trend has been downward, always be ready for potential reversals.

Remember, forex trading involves risk, and it’s always wise to use proper risk management techniques, regardless of your market outlook.

We’ll keep monitoring the USDJPY pair and provide updates as the situation develops. Happy trading!