Last week, the financial markets saw some interesting movements in the British pound sterling. Despite an initial dip following the Bank of England’s decision to cut interest rates, the currency showed signs of recovery by the end of the week. Let’s break down the key factors influencing these changes.

Interest Rate Cut and Initial Impact The Bank of England (BoE) reduced interest rates by 25 basis points last week. This decision initially pushed the pound down against the US dollar, reaching around 1.27. However, the currency didn’t stay down for long.

US Job Data Provides a Boost Unexpectedly weak US employment data gave the pound a chance to bounce back. By Friday, the GBP/USD exchange rate had climbed to 1.2801, showcasing the pound’s resilience.

Positive Economic Indicators for the UK Several factors are contributing to a more optimistic outlook for the British economy:

- Manufacturing Sector Strength: The UK’s July manufacturing index came in at 52.1, exceeding both expectations and the previous month’s figure of 51.8. This marks the third consecutive month above the growth threshold.

- Improved GDP Forecast: The BoE has revised its 2024 GDP growth projection upward to 1.25%, a significant increase from the 0.5% predicted in May.

- Political Stability: A more stable political landscape in the UK is likely to provide additional support for the pound.

Cautious Approach to Monetary Policy While the BoE did cut rates, the decision wasn’t unanimous (5-4 vote). BoE Governor Bailey maintained a cautious stance on future rate cuts, emphasizing the need to keep inflation low and avoid cutting rates too quickly or too deeply.

With core inflation still at 3.5% and noticeable price increases in the service sector, the BoE is expected to maintain a somewhat hawkish position. Market predictions suggest less than 50 basis points in rate cuts for the remainder of the year.

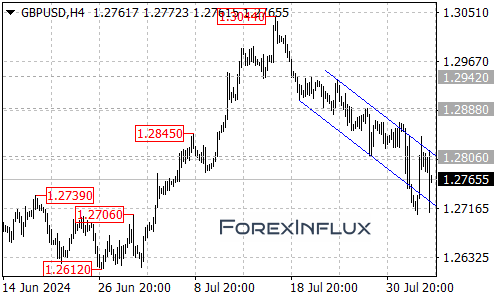

Technical Analysis and Future Outlook From a technical perspective, the pound’s quick recovery after falling below 1.28 against the dollar is encouraging. The next key level to watch is around 1.29. If the pound breaks through this barrier, it could open up further possibilities for growth.

Given the Federal Reserve’s high expectations for rate cuts and the BoE’s more conservative approach, there’s potential for the pound to strengthen in the coming months.

In conclusion, while challenges remain, the British pound is showing resilience in the face of economic shifts. Investors and market watchers should keep an eye on upcoming economic data and central bank decisions for further clues about the currency’s direction.